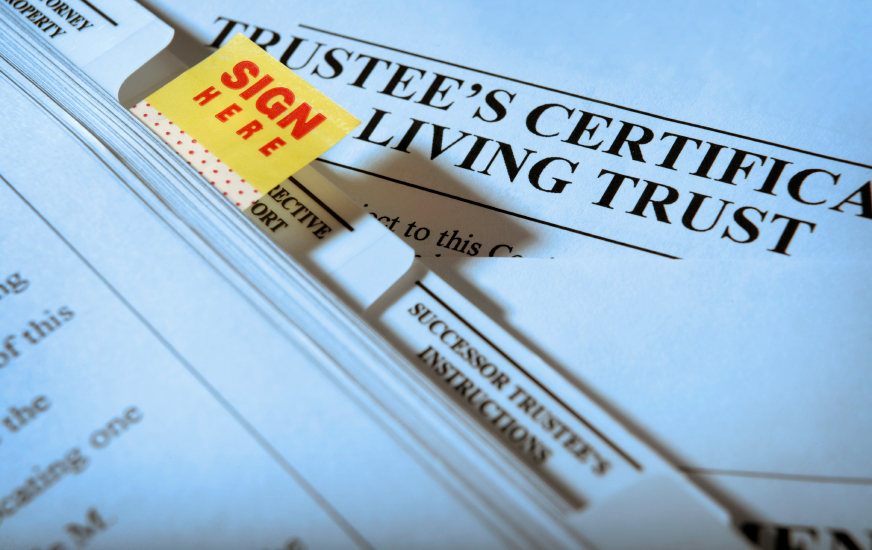

You never know how close you are to your family until you have to share an inheritance with them. I am wrapping-up a case where my client’s mother died, leaving a Will that equally-distributed her real estate between her two somewhat-acrimonious sons. Usually this apartment would be sold, proceeds disbursed, and everyone would go their separate way. However, my client’s brother insisted that he could make them more money if he improved the real estate. His brother (my client) was not so hip on this idea – none of them had any real estate investing experience – but through sheer force, perseverance and presumption his brother had his own son move in (which he did – with a few kewl