Web Link: Long-term Care and How To Fund It

Web Link: Long-term Care and How To Fund It Downloadable PDF:Long-term Care and How To Fund It

Downloadable PDF:Long-term Care and How To Fund It- Download Our PowerPoint Presentation: Long Term Care and How to Fund It

Category: Blog Post

Last Minutes Gifts and Transfers for 2018

Congratulations, you made it through Christmas / Hanukkah / Kwanza, despite the fact you were seated next to your anti-vaxxer cousin who tried to explain to you in two syllable words how the earth actually is flat. All nieces and nephews have been given your gifts (likely a sweater instead of the cool toy they desperately needed to show off to fit in on the school bus), all dishes are cleaned, and all the leftovers have been thrown out unless you are a bachelor. BUT WAIT!! You haven’t wrapped up the Holidays until you make a complete drunken fool of yourself on Snapchat slurring Old Anzine (it’s pronounced “Auld Lang Syne” in Scotland for some reason) and have made the

Bye Bye 24 Hour Caregivers for Aging New Yorkers

Many thanks to Michael LaMagna, Esq. of Riker Danzig and Evan Gilder of Redlig Financial Services for their initial article that prompted this blog. Caring for elderly family members is as exciting as spending your bachelorette party watching C-SPAN reruns (elected officials excluded, of course), so why not pay another person to help your aging Grandma or Dad feed, bath and toilet themselves? And while you are at it, why not have that person “live-in” with Grandma 24 hours a day but only pay the for 13 hours of that work at minimum wage? These were the rules permitted in New York for live-in caregivers, provided they had an 8-hour sleeping period and 3 meal breaks equaling one hour each.

Should You Treat Your Kids Evenly in Your Estate Plan?

I believe you do not need to treat children equally in your estate plan, even if they are equally responsible, equally financially-empowered, and on good terms with you and one-another. Some parents follow differing distributive patterns under Sharia Law or other cultural edicts, others leave disparate amounts to children if one has several children of their own and the other child does not. In the end, the decision of how to bequeath one’s money is the client’s decision. I had one couple who decided to almost completely disinherit their daughter. She was an active opioid addict for several years, and they felt leaving her substantial money (even if utilizing a trust with a substance abuse provision that would limit her

A Funeral Fit for a Queen / King: Aretha Franklin v. John McCain

At the risk of sounding disrespectful (as opposed to actually being disrespectful, which I can also be at times), please allow me to be honest: We have all been to festive and frightening weddings, jovial and pathetic birthdays, and good and bad funerals. But instead of me brooding over how I never received a meal at my sister’s wedding eight years ago, let’s focus on what really matters: The people who spoke up, and what they said. John McCain’s funeral hosted a well-groomed, thoroughly vetted procession of speakers, guests and attendees. His eulogy by his daughter was heartfelt and appropriate for an American hero. He was even clear about who should and should not attend his funeral (while President Trump’s

Don’t Be So Sure Aretha Franklin Didn’t Have an Estate Plan…

Sadly, last week the Queen of Soul passed away with almost no hints beforehand that her death was imminent. And then, in yet another sensational example of Rock Stars behaving badly, the media rushed to declare that Aretha Franklin died without a Will, how irresponsible this was, how much money she must have had, and how a bunch of attorneys will now make millions off her estate. To reiterate my past-stated believes: Today’s mainstream media (not to mention non-mainstream media) is at best a conveyor of a little fact with a lot of opinion, and at worse completely full of ****. But stories about irresponsible celebrities sell in newspapers, tabloids, TV, radio, even in professional journals. I don’t believe it,

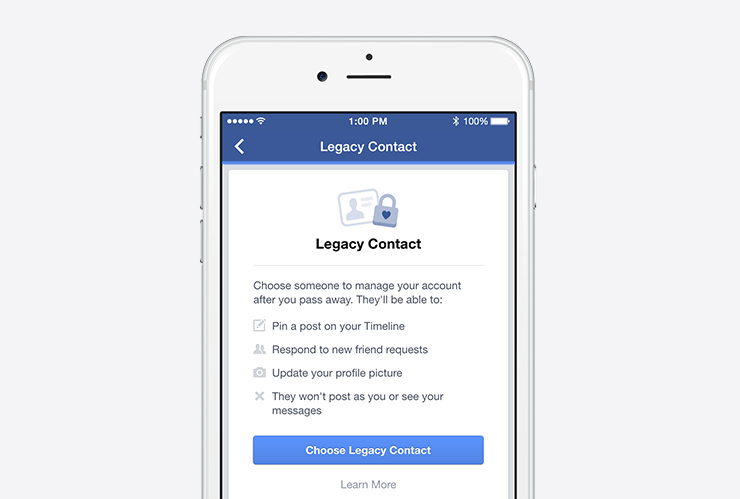

Facebook After Your Death: Enter the “Legacy Contact”

My Grandpa Joe died in 2012 at the age of 90, but before he passed he was able to figure out how to set up a Facebook account – no small feat for a man born before the invention of refrigerators, Ford’s Model T and frozen food. So, you can imagine my surprise when my Facebook account suggested I might want to “Friend” my grandfather in 2014. While Friending a deceased individual seemed novel, I sensed that continuing our actual relationship was one of the few things beyond Facebook’s ability to monitor. But while the law has slowly figured out that an Executor or Administrator of your estate is legally permitted to access your personal email and social media

Guest Blog: Why you should place your home in a Trust

If you are a homeowner in your 50’s or older, you should transfer your real property into an Asset Protection Trust. Having your name on the deed (title) of the home exposes you to risk of lawsuits, creditors like Medicaid and other medical providers, and of course your heirs will have to deal with the costly and lengthy probate process after your death. If however, you place your home into an Irrevocable Asset Protection Trust, you are protecting your home and ensuring an easy and quick transition of the property to your children (or to whomever you designate) after your passing. When your name appears on a deed to a home, the property belongs to you. If you are involved

Guest Blog: Doing Separate Finances Right (in Marriage)

Many couples today are managing their finances separately. They may be doing this because of dual income households, second marriages or relationships with children from a prior relationship. This arrangement may work well while the couple remains unmarried and as long as the relationship remains strong. However, what happens if the couple gets married and then decides later to divorce? In New York, during marriage, all income earned and accumulated is deemed to be “marital property,” and as such, is subject to distribution in the event of divorce. This is true even if the couple has been managing their finances separately – maintaining their own savings accounts; holding individual retirement and investment accounts; and keeping separate credit cards and other debt. As a family and divorce attorney,

Guest Blog: The Most Powerful Legacy to Leave Your Heirs (Even If You’re Not Rich!)

When clients hear about my concentration in tax law, most of them offer a false belief that they don’t have enough assets to merit the services of a tax attorney. While it’s true that the tax law often favors the mega-wealthy, the Internal Revenue Code is full of nifty (and perfectly legal) techniques the everyday family can use to maximize wealth. Perhaps my favorite way for the common citizen to get ahead on both income taxes and even estate taxes is by optimizing retirement accounts. Retirement accounts come in all shapes and sizes, but in general, they can be put into two broad categories: inherited retirement accounts (IRAs) and non-IRAs. The concept underlying both varieties is the same: the government